Minimum 15% Global Tax: new steps on the most relevant tax measure of recent years for large Groups of Companies

Among other provisions, the Bill contemplates a very strict penalty regime, establishing fixed fines of 10,000 euros for each data point or set of data that should have been included in the declaration (in cases of failure to submit or incomplete submission of the informative declaration), with a limit of 1% of the group’s net turnover. We analyze the fundamental aspects of this complex regulation.

The Ministry of Finance and Public Function approved in December 2023 the Draft Bill to establish a global minimum Complementary Tax (CT) of 15% for multinational groups and large national groups, as we reported in our January 2024 post. The processing of the regulation has continued, leading to the approval by the Council of Ministers (on June 4, 2024) of the Bill, for its submission to the Parliament, thus initiating its parliamentary procedure.

The CT aligns with the initiatives of the OECD and the European Union (EU), which aim to ensure that all groups present in the jurisdictions of the OECD inclusive framework or in EU territory are subject to minimum taxation rules. In compliance with these international commitments, the vast majority of EU Member States and other countries such as the United Kingdom and Canada have already approved minimum taxation legislation for large groups. However, other relevant countries, such as the United States and China, have not yet done so, which adds uncertainty about the final outcome of this project, initially conceived with a global approach and scope, and whose effectiveness raises doubts if some of the main global players ultimately remain outside.

The CT has an overly complex regulation, whose fundamental aspects we outline below.

Basic lines of the minimum tax

The CT will apply to multinational or large national groups with a presence in Spain whose net turnover, according to the consolidated financial statements of the ultimate parent entity, exceeds 750 million euros, in at least two of the four years prior to the reference year.

The CT must be paid when the effective tax rate (ETR) of a group is below 15%. To calculate the ETR, the starting point is the accounting profit before taxes and the Corporate Income Tax (CIT) expense recorded in each jurisdiction where the group is present, and certain adjustments are applied to these items for concepts that are normally also excluded from the CIT tax base. However, the CT and CIT present notable differences, as:

- The thresholds and requirements for certain concepts to be excluded from the calculation of the CT and the CIT tax base may differ. For example, in the case of dividends, the minimum participation thresholds and holding period of such participation do not coincide.

- The exemptions provided by the CIT regulations of each jurisdiction will normally not be contemplated in the calculation of the CT, so they will penalize the determination of minimum taxation. The use of deductions is also penalized, as their application reduces the ETR of the groups.

- In general, the compensation of Tax Loss Carryforwards (TLCs) and temporary differences is not penalized, because the corresponding deferred CIT income or expenses for their generation and reversal are considered in the ETR calculations. In any case, for CT purposes, the rate at which the generation and reversal of these concepts is computed is 15%.

Once the ETR is calculated, the CT rate will amount to the positive difference between the minimum rate of 15% and the ETR. The CT rate is then applied to the accounting profit before taxes, after deducting from this an amount based on economic substance, which is calculated as a percentage of the group’s tangible assets and wage costs in each jurisdiction.

The CT is collected through three types of provisions or tax figures according to the following order:

- The national CT, whose purpose is to ensure that all entities located in Spanish territory that are part of the affected groups pay a minimum of 15% in Spain.

- The primary CT, which will apply when the ultimate parent or any intermediate parent of a multinational group is located in Spain, when its subsidiaries are taxed at an effective tax rate lower than 15% in their respective jurisdiction.

- The secondary CT, which acts as a closing mechanism and is activated when the minimum level of taxation cannot be ensured through the two previous formulas. This rule applies to subsidiaries resident in Spain whose parent companies do not apply the primary CT.

The Bill contemplates a specific penalty regime, strikingly severe, consisting of fixed fines of 10,000 euros for each data point or set of data that should have been included in the declaration, with a limit equivalent to 1% of the group’s net turnover, in cases of failure to submit or incomplete submission of the informative declaration. The resulting potential infractions can be significant.

Transition to the minimum tax

- Entry into force of the obligations regulated in the Bill. In general, the national CT and the primary CT will apply in Spain for the first time in fiscal years starting from December 31, 2023, while the secondary CT will apply, as a general rule, one year later. As an exception, in groups where the ultimate parent is subject to a nominal CIT rate equal to or greater than 20%, the secondary CT will not come into force until January 1, 2026. Considering that the secondary CT is one of the most problematic components of the regulation (among other things, because it taxes profits generated outside the jurisdiction that collects it), this temporary exemption is a relief measure for groups with U.S. or Chinese parent companies, countries that have not yet approved their own CT, as we mentioned earlier.

- On the other hand, a transitional period is established in which the CT will not be required if certain requirements are met:

- Safe harbors based on the information contained in the admissible country-by-country report (CbCR). For fiscal years 2024, 2025, and 2026, the CT will not be required, provided that one of the following three requirements is met:

- That (i) the group’s total revenues in a jurisdiction are less than 10 million euros and (ii) its profit before taxes in that jurisdiction is less than 1 million euros.

- That the quotient resulting from dividing the CIT expense by the profit before taxes in a jurisdiction exceeds the following percentages:

- 15% for fiscal year 2024.

- 16% for fiscal year 2025.

- 17% for fiscal year 2026.

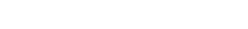

- That the wage costs and the value of tangible assets, multiplied by the following percentages, exceed the profit before taxes obtained by the group in a jurisdiction:

If in any fiscal year, in any of the jurisdictions, none of the tests is passed, the safe harbor cannot be applied in that jurisdiction in any subsequent fiscal year within the transitional period.

If in any fiscal year, in any of the jurisdictions, none of the tests is passed, the safe harbor cannot be applied in that jurisdiction in any subsequent fiscal year within the transitional period.

- Safe harbors based on the information contained in the admissible country-by-country report (CbCR). For fiscal years 2024, 2025, and 2026, the CT will not be required, provided that one of the following three requirements is met:

- Groups in the initial phase of international activity and domestic groups. The CT will not be required in the first five years (i) in the case of groups in the initial phase of their international activity (i.e., subsidiaries in a maximum of six jurisdictions and global net value of tangible assets equal to or less than 50 million euros in jurisdictions other than the reference jurisdiction) and (ii) in exclusively domestic groups.

- Additionally, a regime for deferred tax assets and liabilities during the transitional tax period is regulated. Specifically, deferred tax assets or liabilities recorded or disclosed in the financial statements at the beginning of the transitional tax period (i.e., the first tax period in which a group is subject to CT rules) will be considered in determining the ETR of the transitional period and subsequent tax periods. In other words, the ETR will consider the deferred CIT expense for the use of deferred tax assets covered by this transitional regime, which will significantly reduce the impact of the new rules on tax credits generated in fiscal years prior to December 31, 2023.

- Regarding declaration obligations, generally the CT informative declaration must be submitted before the last day of the 15th month following the last day of the tax period, although, for the transitional period, it must be submitted before the last day of the 18th month following the end of the tax period (i.e., for fiscal years coinciding with the calendar year and groups subject to CT from December 31, 2023, June 30, 2026). On the other hand, the tax declaration for the transitional tax period must be submitted within 25 calendar days following the 18th month after the conclusion of the tax period (i.e., for fiscal years coinciding with the calendar year and groups subject to CT from December 31, 2023, July 25, 2026).

Undoubtedly, we are facing one of the most impactful developments in business taxation in recent decades. All groups will have to make a notable effort to calculate the CT and comply with the declaration and information obligations in all jurisdictions where they are present.

Regarding Spanish companies, we find a series of specific issues that must be considered:

- Certain tax regimes with strong roots and justification, such as R&D&i deductions or REITs, should not be significantly affected by the new rules. However, a greater degree of clarity in the Law or in the Regulation that develops it would be desirable to avoid unwanted surprises.

- In contrast, negative impacts are expected for groups under regimes such as cooperatives, the Canary Islands Special Zone, or the foral territories. These groups should explore mechanisms such as the exclusion based on economic substance or joint calculation with other Spanish entities of the group not under these regimes to mitigate the effect of the CT

Patxi Arrasate Roldan