This expansion of the investment possibilities of the RIC is carried out with the declared purpose of overcoming the housing emergency situation in the Canary Islands.

Since the modification introduced in Article 27 of Law 19/1994, of 6 July (amending the Economic and Fiscal Regime of the Canary Islands), by Royal Decree-Law 12/2006, of 29 December (which came into force on 1 January 2007), the Reserve for Investments in the Canary Islands (RIC) could not be materialized in housing intended for rent, except in the case of promotion by a social housing entrepreneur according to Decree 27/2006, of 7 March, which regulates the actions of the Canary Islands Housing Plan.

In a generic way, however, the regulation alluded to the possibility of investing in housing intended for rental by entrepreneurs subject to Law 7/1995, of 6 April, on the Regulation of Tourism in the Canary Islands (LOTC), provided that they were properties used for tourist activities carried out in hotel and non-hotel establishments. The latter modality was integrated, in turn, into four types of establishments: the apartment, the villa, the emblematic house and the rural house. This reference to the LOTC opened the door for the Directorate General of Taxes, through several binding resolutions (V3756-16, V3757-16, V4344-16, V2972-17 and V1731-18), to conclude that the RIC could be materialized in homes intended for holiday accommodation (according to Decree 113/2015, which approves the Regulation of holiday homes in the Canary Islands).

Law 8/2018, of 5 November, however, again amended article 27 of Law 19/1994, establishing that “in no case, the reserve for investments in the Canary Islands may be materialized in the acquisition of real estate for housing for tourist purposes“. Nevertheless, despite the fact that the regulation expressly referred to “housing for tourist purposes”, its objective, as can be seen from all the parliamentary processing and the mandatory report issued by the Parliament of the Canary Islands on said regulation, was to exclude “the possibility of its use in holiday rental homes”

Subsequently, due to the housing emergency classified as a housing emergency in the Canary Islands, Law 7/2024, of 20 December, introduced a significant novelty in relation to the RIC, by making it possible to materialize it in the rehabilitation of subsidized housing (classified as such according to the provisions of Law 2/2003, of 30 January, on Housing in the Canary Islands) intended for rental in favor of people registered in the Public Registry of Applicants for Protected Housing of the Canary Islands, including in the value of the investment that corresponds to the land.

These modifications were immediately perceived as insufficient by different sectors, giving rise to a much more profound reform operated by Law 6/2025, of July 28 (with effects for periods beginning on or after January 1, 2025).

This law has opened a new investment landscape in the Canary Islands with the ultimate purpose declared in its Statement of motives of allowing the purchase, promotion or rehabilitation of homes for rent as a mechanism for materializing the RIC, “due to the fact that the Archipelago is in a situation of housing emergency, which implies the need to mobilize all the necessary resources to solve the housing problem”.

Specifically, the materialization of the RIC is allowed in homes located in the Canary Islands intended for habitual rental, provided that (i) an economic activity of renting housing is carried out, with a person with a full-time employment contract (a requirement that can be extrapolated to all cases of rental of real estate), (ii) the leases are formalized within six months after the acquisition or putting in conditions of habitability of the dwellings, (iii) there is no direct or indirect link between the landlord and the tenant (a requirement that can also be extrapolated to all cases of rental of real estate); and (iv) the home had not been rented in the year prior to its acquisition.

In addition, the requirement to maintain the investment in the event of vacancy of the home is made more flexible, if it is rented again within a maximum period of six months (in which case the mandatory maintenance period of 5 years will be extended for as long as the home has remained unoccupied); and it is clarified that the materialization of the RIC in job creation directly related to previous investments will be allowed.

The possibility of materializing the RIC in the subscription of shares or holdings in companies that carry out this activity of renting housing in the archipelago is also contemplated, provided that the same requirements are met. And it is established that personal income tax taxpayers who pay tax in direct estimation and meet the above requirements may also materialize the RIC in the indicated investments.

On the other hand, the law reinforces the prohibition of materializing the RIC in the acquisition, rehabilitation or renovation of properties intended for holiday housing, “according to its regulation as a non-hotel modality in Decree 142/2010, of October 4, which approves the Regulation of the Tourist Activity of Accommodation, and in Decree 113/2015, of 22 May, which approves the Regulation of holiday homes in the Autonomous Community of the Canary Islands”, thus qualifying the previous mention of “homes for tourist purposes” and, clarifying, therefore, the suitability of other properties subject to the LOTC such as aparthotels.

In relation to investment in the acquisition and rehabilitation of subsidized housing for lease (including land), the requirement that the lessor be the developer company is eliminated, also allowing the intervention of public entities, entities or bodies in the intermediation between landlords and tenants. In any case, the taxpayer must continue to comply with the requirement of carrying out an economic activity of renting housing, having at least one person employed with a full-time employment contract for said exploitation.

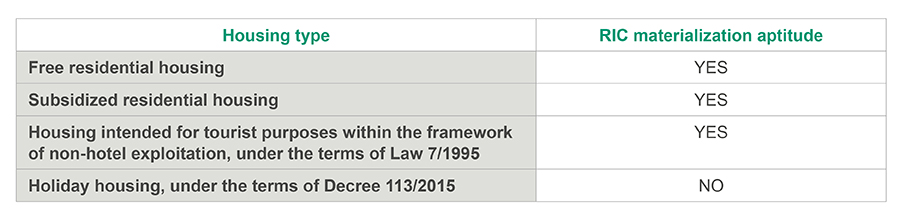

By way of summary, considering the different types of properties, the following types of investment in rental housing can be distinguished and their suitability or not to materialize the RIC:

This is an important reform that expands the investment possibilities of the RIC, without prejudice to the fact that, in the event of any new investment, a case-by-case analysis must be carried out, paying special attention (in addition to the suitability of the benefits to endow the RIC), the type of asset, whether the leasing activity can be classified as such or the prohibition of the leasing being carried out between related parties, among other issues.